Get This Report on Tax Planning Canada

Wiki Article

Everything about Private Wealth Management Canada

Table of ContentsIa Wealth Management Can Be Fun For AnyoneIa Wealth Management for DummiesThe Single Strategy To Use For Investment RepresentativeThe Main Principles Of Lighthouse Wealth Management The Best Guide To Lighthouse Wealth ManagementThe Basic Principles Of Lighthouse Wealth Management

“If you're purchasing a product, state a television or a pc, you might would like to know the specs of itwhat tend to be its elements and just what it may do,” Purda details. “You can contemplate getting economic information and support just as. Folks have to know what they are getting.” With monetary guidance, it’s vital that you understand that the product is not ties, stocks and other assets.It’s such things as cost management, planning for your retirement or paying down financial obligation. And like buying a computer from a dependable company, customers need to know they've been getting economic guidance from a dependable professional. One of Purda and Ashworth’s best findings is approximately the costs that monetary coordinators charge their customers.

This held correct it doesn't matter the fee structurehourly, percentage, possessions under management or flat rate (in learn, the dollar property value fees was actually the exact same in each situation). “It nonetheless relates to the worth proposition and uncertainty in the customers’ part which they don’t determine what they might be getting in exchange of these costs,” states Purda.

Retirement Planning Canada Things To Know Before You Buy

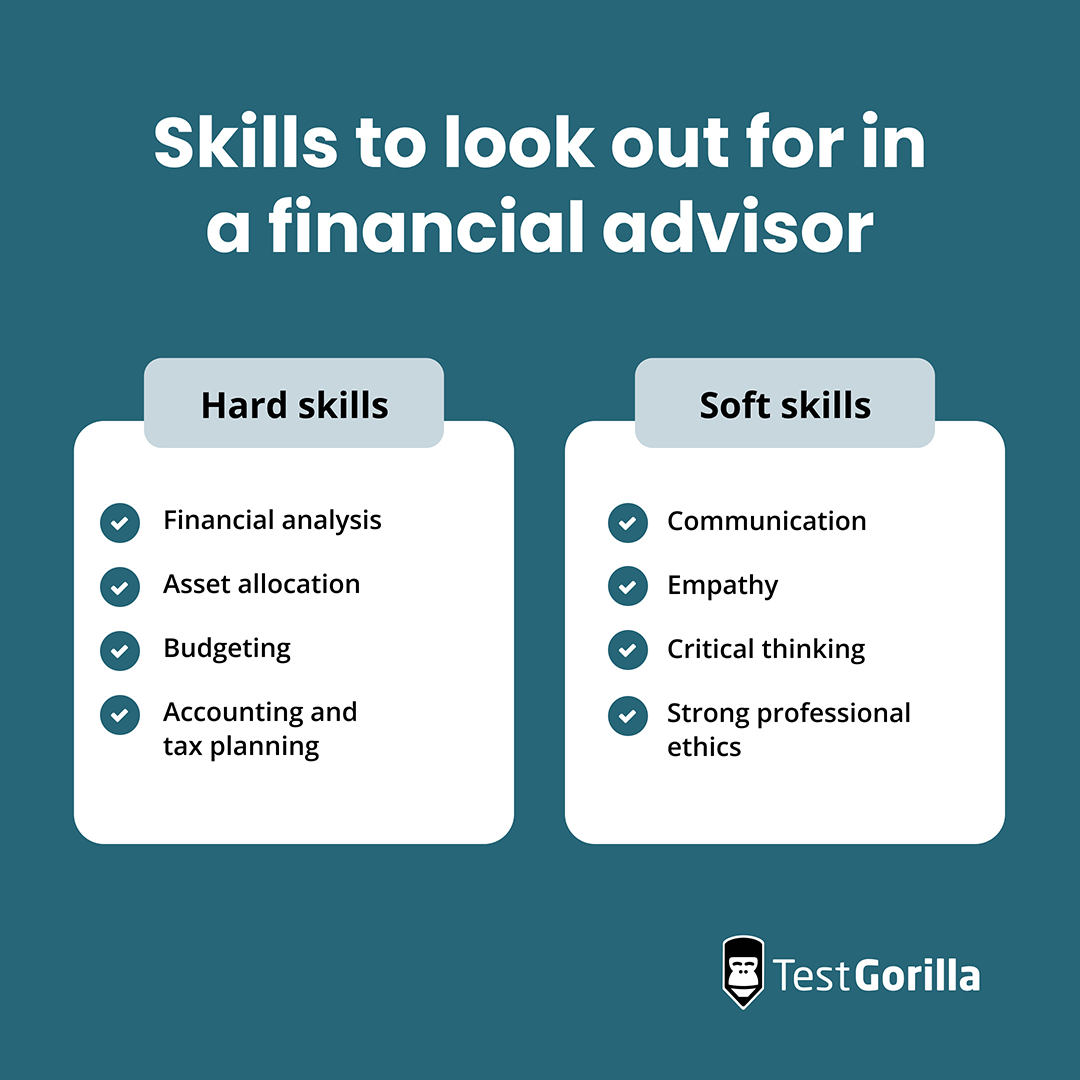

Pay attention to this short article When you listen to the word economic expert, what pops into the mind? A lot of people think of specialized who is going to provide them with economic information, specially when it comes to investing. That’s a good place to start, although it doesn’t color the photo. Not really close! Economic analysts might help individuals with a lot of other cash targets as well.

An economic specialist assists you to build wide range and shield it for all the long haul. They can approximate your personal future financial requirements and program tactics to extend the retirement cost savings. They're able to in addition advise you on when you should start experiencing personal protection and utilizing the cash inside retirement records to prevent any nasty penalties.

The Only Guide to Independent Financial Advisor Canada

They are able to guide you to determine what shared resources are right for you and show you simple tips to manage to make many of your financial investments. They're able to also make it easier to comprehend the threats and just what you’ll should do to accomplish your goals. A practiced financial investment pro will help you remain on the roller coaster of investingeven as soon as your investments simply take a dive.

They are able to provide you with the advice you'll want to make a strategy to help you ensure that your desires are carried out. And also you can’t put a cost label about satisfaction that include that. In accordance with a recent study, the common 65-year-old few in 2022 needs to have around $315,000 conserved to pay for health care expenses in pension.

Rumored Buzz on Ia Wealth Management

Now that we’ve reviewed what monetary advisors do, let’s dig in to the differing kinds. Here’s a beneficial principle: All financial coordinators are economic analysts, yet not all analysts are planners - https://www.pinterest.ca/pin/1151162354742517956. An economic coordinator focuses on assisting people produce plans to attain long-lasting goalsthings like beginning a college investment or preserving for a down payment on a house

So how do you understand which financial advisor suits you - https://www.twitch.tv/lighthousewm/about? Here are a few activities to do to be certain you’re hiring the proper individual. What now ? when you have two terrible options to select? Easy! Discover a lot more choices. The greater amount of options you've got, the more likely you are to produce an excellent choice

Facts About Independent Investment Advisor Canada Uncovered

All of our Smart, Vestor plan makes it possible for you by revealing you doing five financial analysts who are able to serve you. The best part is actually, it's totally free attain linked to an advisor! And don’t forget about to come to the interview prepared with a list of questions to ask to help you ascertain if they’re a great fit.But tune in, even though an advisor is actually wiser compared to the typical keep doesn’t provide them with the legal right to tell you what you should do. Often, analysts are full of themselves because they do have more degrees than a thermometer. If an advisor starts talking-down for your requirements, it’s time and energy to demonstrate to look at more info them the door.

Understand that! It’s essential that you as well as your financial advisor (whoever it ultimately ends up becoming) are on equivalent page. You need an advisor who has a lasting investing strategysomeone who’ll motivate you to definitely keep investing constantly if the market is up or down. investment representative. Additionally you don’t desire to use someone who pushes that spend money on something that’s too high-risk or you’re unpleasant with

Private Wealth Management Canada - An Overview

That blend offers the variation you will need to effectively invest for your longterm. Whenever research financial analysts, you’ll most likely stumble on the term fiduciary duty. All of this implies is any expert you hire has to act in a way that benefits their particular customer and never their own self-interest.Report this wiki page